Redefining Entrepreneurship — 4 Common Myths Debunked

In the end, it comes down to what we teach — how to become an entrepreneur or how to develop an entrepreneurial mindset. – Article on Huffington Post

The Dallas Entrepreneur Center (DEC)

New Book: Launching a Biz: The First 100 Days

New Book by Bruce Barringer, Oklahoma State University Entrepreneurship Department Chair. “Launching a Biz: The First 100 Days” Selected Editor’s Pick

#entrepreneurship #OSU

Entrepreneur vs. New Venture Creator?

I attended the Austin Technology Council CEO Summit several weeks ago and observed that there were strong feelings about some of the presenters’ positions among the attendees. Statements like ‘we focus too much on lifestyle startups and not enough on worldchanging ideas’, ‘we need exponential growth businesses’ and finally, the one that got the strongest reaction from many in the crowd, ‘there’s not a shortage of capital, there is a shortage of companies worth funding’ really struck a chord with many attendees and there was much discussion both in support and against these positions during the breaks.

Upon further reflection and conversations with other entrepreneurs at the event I realize that the statements appear true from the lens of venture investors and entrepreneurs looking to create exit-focused endeavors. For those people looking to create exit-worthy businesses these statements ARE correct and lifestyle businesses are likely not the correct focus. Understanding the position and reactions requires an understanding of the different perspectives of ‘entrepreneurship’. I frequently hear entrepreneurs lately describe themselves by how many ‘successful exits’ that they have had rather than by the number of successful businesses that they have built. Entrepreneurship and New Venture Creation are used interchangeably as is appropriate. There remains some confusion among the community about what entrepreneurship means.

According to the authors of one of the top academic textbooks on New Venture Creation, Bruce Barringer and Duane Ireland, there are three types of start-up (new venture) businesses:

Salary-substitute Firms – these firms allow the owners to be their own bosses and to develop and grow their businesses at a level commensurate with the personal lifestyle desired. Salary substitute CAN (and often do) develop into large businesses but they typically are not exit-focused. Many service and local product businesses fit into this category. Digital Marketing firms where the innovation creation is low but innovation deployment is high may be one example of a salary-substitute business.

Lifestyle Firms – these firms conform to the specific interests of their owners passions. An example of this would be a music retail business which grows into a multiple location business and is tied to the passion for music of it’s founder. Lifestyle businesses may be large and even multinational, but they are rarely innovative or designed for an exit. These businesses may be innovative in their specific areas but are not usually driving broad innovation. Some digital media ventures are lifestyle businesses (digital filmmakers, gaming, bands, etc).

Entrepreneurial Firms – these firms bring new products and services to the market and deliver innovation in one or more areas. These firms are developed to create value for their investors and customers and strive to drive growth and scale quickly. Because of the nature of their value offerings they are frequently started with an ‘exit’ in mind, whether that exit is an IPO or M&A activity.

The term Entrepreneur is a derivative of the french words Entre (between) and Prende (to take). It originally applied to the person between the investor and inventor/creator who assembled and integrated the resources necessary to transform the idea/product/service/creative into a a viable business (Barringer, Ireland, 2008). Entrepreneurship is about making ideas into businesses, not just about building businesses to exit (although that is one very popular form of entrepreneurship).

Many startup endeavors today are actually lifestyle businesses or salary substitute businesses. There is nothing wrong with those types of businesses, in fact, our economy is made up of a great number of these types of businesses. You could argue that some of the recent IPOs are lifestyle or salary-substitute businesses that have been dressed up for scale rather than true entrepreneurial ventures.

Where we run into challenges is when there is a disconnect between the investor, entrepreneur, and inventor/creator in terms of the true nature of the business being formed. There is a risk that we have had an inordinate amount of focus and emphasis on venture capital and public market approaches while not paying enough attention to the needs and nurturing of salary substitute and lifestyle businesses as valid forms of entrepreneurship. These businesses provide jobs, services, and local economic expansion. A good mix is necessary to have a healthy economy.

There is an opportunity for all three types of ventures. A healthy business environment has ecosystem, investment sources, and infrastructure to support all three of these types.

Those speakers weren’t wrong at the ATC CEO Summit. They were exactly right – for the type of new ventures that they are interested in. I’m hoping that we can start a dialogue about how to nurture and develop the other types of ventures.

The Funnel and Social Media

I’ve been in several presentations and meetings lately where there has been an inordinate amount of discussion and focus on Conversion and the role of social media and social networking. I’ve heard phrases such as ‘it’s not about content for content’s sake, it’s about content that leads to conversion’ or ‘your goal should be conversion or the attainment of some action from the user that can be interpreted as a conversion’.

Both of these statements, while true to a large extent, oversimplify and marginalize the opportunity with social media for marketers. There are three major components to the funnel (some marketing literature highlights four or five but for simplicity I’ll focus on the major three funnel sections). These are Awareness, Consideration, and Conversion.

Social Media and Social Networking can play a major role in the Awareness part of the funnel. This section is about creating content that is appealing, worth sharing (viral), and has value for the readers/viewers/consumers, whether the value is for laugh and entertainment value, such as the DollarShaveClub.com video or an Infographic on Security from a security vendor. These are general content that are worth sharing and help bring potential customers into the top of the funnel. Measuring this may be as simple as measuring views, clicks, or tracking as a campaign component through Google Analytics.

Consideration is also an important component of the funnel. Creating content specifically for users that have already ‘opted in’ through Facebook Pages, Twitter connections, or other methods allows the marketer to tune the message to a much more focused ‘sales’ message with the intent of deeper interest. This content may be things like offering webinars, whitepapers, or Hangout events on Google. The goal of these would be to move customers into the true conversion phase. Connecting with the users individually at the end of this process is critical to really driving conversion. Tracking things such as the collection of contact information, a request for more information, or a user opt-in for additional contact are all ways of measuring whether the consideration methods are working optimally.

The final phase is the conversion phase and this is the ‘rubber meets the road’ phase. This is the conversion of a prospect to a sale, the conversion of a casual reader to a committed follower, the conversion of a passive user to an active user, etc.

When people talk about focusing on conversion the risk is missing the optimization and opportunity offered by providing content and interacting with the community to drive awareness and encourage consideration.

Executive Hiring

I have a simple test that I occasionally use to figure out if an executive is a reasonable leader. It’s one that is useful sometimes (organizational situations may make this a difficult test to pass). That test is; do any former employees follow the executive to his/her new company. Now this test is really a single attribute test – it highlights whether employees will follow someone to a different company (hence the ‘leader’ title). It DOESN’T test for the reasons behind the employee moves, quality of the leadership, or the direction of the migration (did the employee follow the leader or did the leader pay the employee to follow).

Regardless, employees following executives to new opportunities is an indicator of leadership and team commitment. I’ve thought about this from time to time as I’ve experienced different executives and have really paid attention to the ones that have teams around them that are willing to move to new roles with the leadership. Why is it that some executives join a firm and people from the old firm send in resumes right away and other executives join a firm and there is no trace of their former employee base anywhere around? I also wonder about companies that hire executives with a track record of bringing people with them to manage existing teams. Sometimes this works well and sometimes it can be an organizational disaster.

My view is that this comes down to two different attributes; leader with broad group interest vs. self-focused leader and team building need vs. existing team leadership need. These are important attributes to understand because they will help illuminate what opportunities and risks new executives may bring to your emerging organization.

In some cases, organizations have teams in place that needs executive management and there is a desire NOT to bring on an executive that has a ‘ready-to-go’ team ready to follow. Bringing on an exec with strong former team loyalties and structures may be inviting massive churn into your organization as the executive brings on ‘their team’ and moves out existing employees.

In other cases, an executive may be needed to build a new capability or organization and an executive that has a rolodex of experienced people willing to follow him/her would speed up the team development and reduce organization ramp time.

Sometimes a team exists with solid performers but there is not the experience, strategic planning/vision capability, industry relationships, or management capacity and a strong executive is needed. In that case, an executive that has a good track record of management but not a ‘ready team’ may be preferred.

Many times executives are hired based on their personal accomplishments rather than the organizational leadership and development skills that they have. It’s important when hiring executives for startups and emerging businesses that consideration is given to the type of leader being hired. It’s important for both the health of the business and for the likely outcome of the executive hire.

Dedoose – providing context to qualitative research

One of the challenges that I have found over the years in my career has been getting technical (read engineering) people to accept and appreciate the value of qualitative research.

In marketing, customer feedback is a critical part of understanding what customers need and value. Whether the feedback is around product features, advertising, customer satisfaction, messaging, or other important customer engagement areas, qualitative research plays a key role.

Technical people by nature tend to gravitate towards quantifiable data. This is why surveys with Likert scales (e.g. 1-5 ratings) or numbers driven research (the volume of units or click data) is frequently favored by more quantitative minded people. Part of this is because qualitative data is, by the very nature of the data, open to interpretation and easy to manipulate. Regardless, while quantitative data provides the measure, qualitative data provides the flavor – it provides the deeper understanding behind the quantitative data.

Because of the challenge of presenting qualitative data to broader audiences, I’ve learned over the years to use several tricks to make this data more palatable. Things like boiling down the data to the ‘Top 10 most common statements” or “This message was consistent among X number of focus group participants”. This works in some cases but it still leaves a lot to be desired.

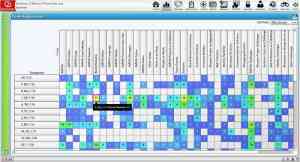

Enter a fantastic new tool called Dedoose. Dedoose is an online research tool that can be used individual or in teams of researchers. It allows for the management of qualitative data or mixed methods input (both qualitative and quantitative data).

Dedoose provides a structured way to code transcripts from customer interviews, focus group research, email or online responses (think customer service emails as research input!). Based on the coding, the data can be manipulated and presented in ways that make it understandable and broadly usable. Because of the workgroup capabilities, people outside the research team can be given access to the data for their own review and manipulation (dangerous, I know – but at least possible!).

One of the (many) nice things about Dedoose is that it’s easy and fun to use. Our research group had several folks that were not computer or data oriented and they were able to immediately begin using Dedoose and contribute to our project.

Why is this such a powerful approach? It allows marketing teams to conduct research using different methods and use the Dedoose platform to integrate them into usable, actionable data fast and accurately. Spending time defending qualitative findings is non-productive time for marketing folks. Tools that provide better integration, analysis, and presentation of qualitative data are invaluable in getting to the answer more quickly and getting organizational understanding more quickly.

I have no direct relationship with Dedoose other than as a subscriber. I’m using it in some of my academic research and it’s one of the new tools that I’ve come across that I believe provide real value for marketeers.

Rumors of the Death of the 4 P’s are Greatly Exaggerated

With all of the excitement of Social Media and Digital Marketing, there have been a lot of articles and commentary lately about the demise of the 4P model. For those that don’t know or need a refresher, the 4P model stands for Product, Pricing, Placement, and Promotion. A good, simple overview of the 4P model is presented on the NetMBA site.

Ogilvy and Mather published an article about the 4Ps being out and the 4Es being in. While I agree with the value of the 4E model as an extension or addition to the 4Ps (I have this as required reading in the undergraduate digital marketing course that I teach), it does not replace the 4P model.

There have been numerous attempts to EXTEND the 4P model over time. There have also been arguments about what constitutes the main P’s with some arguing that People should be added (for customer segmentation).

Some argue that the 4Ps have been replaced by the 7Cs. An alternative way of thinking about this is that the 4Ps approach the marketing mix from the vendor/producer viewpoint while the 7Cs approach marketing mix from the Customer/Consumer standpoint. I think that this is another model that goes deeper and is complimentary to the 4P model.

As a way of highlighting the continuing importance of the 4P model, I point to the recent issues in the marketplace around Microsoft’s Surface RT tablet launch as a way of showing how critical the 4Ps really are to successful marketing. Regardless of your personal viewpoint (Pro or Con) regarding the Surface RT platform, the product has had a challenging launch and ramp by any objective measure and it can be clearly tracked back to three of the four P’s.

From a Product standpoint, the Surface RT has had strong positive reviews for it’s industrial design but has also had negative responses to it’s lack of available apps and inability to run legacy Windows applications.

From a Pricing standpoint, there has been strong pushback from reviewers on the initial pricing for the Surface RT. While there have been pros and cons about the Surface RT pricing and price positioning (with and without keyboards), the fact that it is raised as a value concern in various reviews shows that Pricing and price-positioning is an important part of the marketing mix.

Finally, Placement has been a major issue as the product was initially available only in Microsoft’s stores and online. There was some commentary early on in the announcements that this was a point product for Microsoft and would not be available through broad distribution as a way to minimize competitive conflict with Windows 8 OEMS but that has proven to be an issue for the product’s acceptance in the marketplace.

From a Promotion standpoint, Microsoft has done a good job of building Awareness. Using the 4P model it is possible to see clearly the challenges that they have in driving Consideration and, most importantly, Conversion.

While there is always value in extending models and creating complimentary models, the claims that the 4Ps are irrelevant are questionable at best. Like good brands, good models stand the test of time.

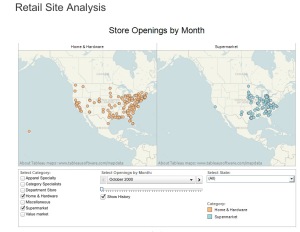

Tableau Software – a great tool for Data Visualization and Analytics for Startups

There is a great deal of discussion about the value of analytics and big data management in the technology industry today. Deloitte’s Center for the Edge has research called ‘The Big Shift’ that has looked at the changing world of global business. Among the research findings are points that suggest that with increasing globalization, lower barriers to entry, and the speed of communications, companies that can collect information, assess it, and act on it quicker than the competition may have some fundamental advantages in the marketplace.

On the other hand, some believe that information analysis is an important way to optimize a business but not as important in the early stage invention mode (I don’t agree with this at all). In his blog posting on KillerStartups, Bo Fishback, the CEO of Zaarly and previously the vice president of entrepreneurship for the Ewing Marion Kauffman Foundation, states that user testing and input trumps data at the early stage of the business.

My view is that information and data is only useful if it can help provide insights. Insights into both what customers/prospects want (for finding gaps and opportunities), what customers/prospects do (for optimizing), and what patterns are not obvious from raw data (for both finding gaps AND optimizing) are very important and can be the difference between leading and losing.

One of the challenges that I’ve run into is that analytics conjures up visions of statistics and complex mathematical equations. Both math and statistics are important to analytics but, with a well developed tool, those should be behind the scenes running the tool, not a required input into using the tool. A good data analytics tool should allow anyone on a startup team to be able to use it, it shouldn’t require a math major to be able to use it.

In my area of interest and research I come across a number of sites, services, and tools that may be interesting for startups. One of them is Tableau Software. Tableau is a Data Visualization tool that allows users to easily connect to datasets. From very simple flat data files (.csv, .xls, .txt) to very complex SQL data structures (Hadoop, SQL Server, Oracle, etc). Tableau can analyze data while the data stays in the repository or the data can be imported into Tableau for offline processing.

The main user interface for the user and the data is through a graphical management panel. Based on the data labels selected, different visual representations are automatically presented to the user to select. These visual representations are active graphs that allow for deeper understanding of the underlying data for the different objects. Things like mapping data to geographic map representations are quick and easy.

Why is Tableau interesting? Four main reasons; 1) it has a graphical interface that is ridiculously simple to use (easier than Excel for graph generation!), 2) it comes with a long library of data connectors and linking multiple databases is handled by Tableau – no complex SQL code to write, 3) it is fast and intuitive, this tool is appropriate for use across the organization, from a fresh marketing staffer to an experienced data analytics expert. and finally, 4) the price – it’s not expensive! (don’t tell them).

I was introduced to this tool during a Ph.D. course at Oklahoma State University where we are using it for some data mining. I’ve now used it extensively for other business analysis work and I’ve found that it has both saved time and provided useful insights by visually representing and allowing the manipulation of the visualization.

Tableau has a download of the tool available for trial.